Tanda HR

HR software to manage your hourly workforce, from onboarding to offboarding.

Hire, onboard, and performance manage staff within Tanda’s all-in-one system.

Onboard, Hire, and Train Staff

Simple digital employee onboarding for new staff. Automatically verify tax and super details. Collect all employee forms and details through a self-service portal.

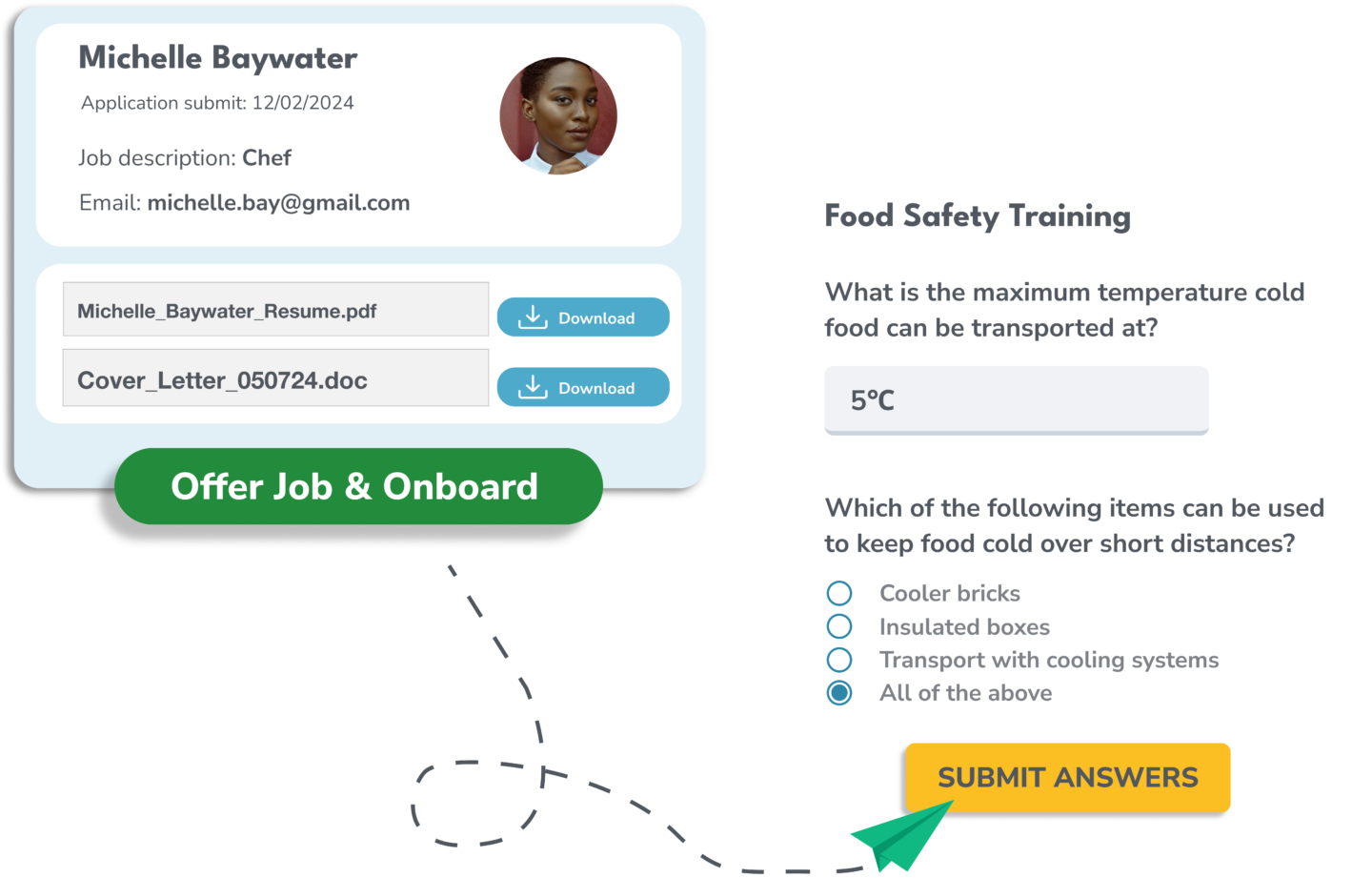

Speed up your recruitment process with Tanda Hire, an Applicant Tracking System (ATS). Notify previous candidates that a new job has opened, and progress successful applicants straight into your workforce.

Train staff with forms and inductions and give staff the best start.

All-In-One Workforce Software

HR is part of Tanda’s all-in-one suite that includes Workforce Management and Payroll software.

With this single source of truth, your HR team only needs to update employee records in one place, reducing inconsistencies and wasted admin time.

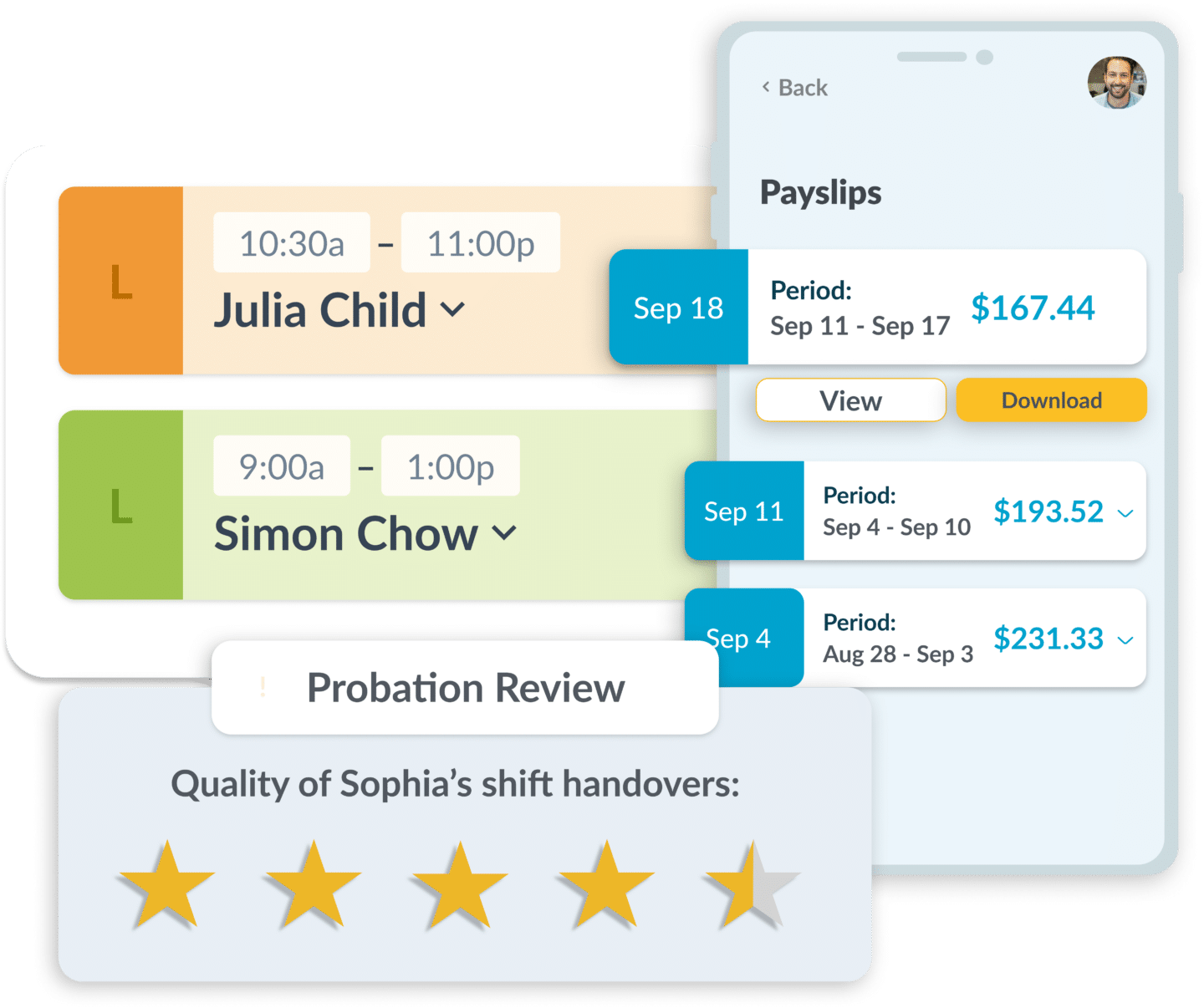

Cultivate Talent with Performance Management

Tanda HR helps get the most out of hourly paid staff. Performance manage staff with templated written warnings, and motivate your team to achieve their best.

Keep a record of documents sent to staff, including personal forms, and qualifications like working with children checks. Communicate clearer than ever before.

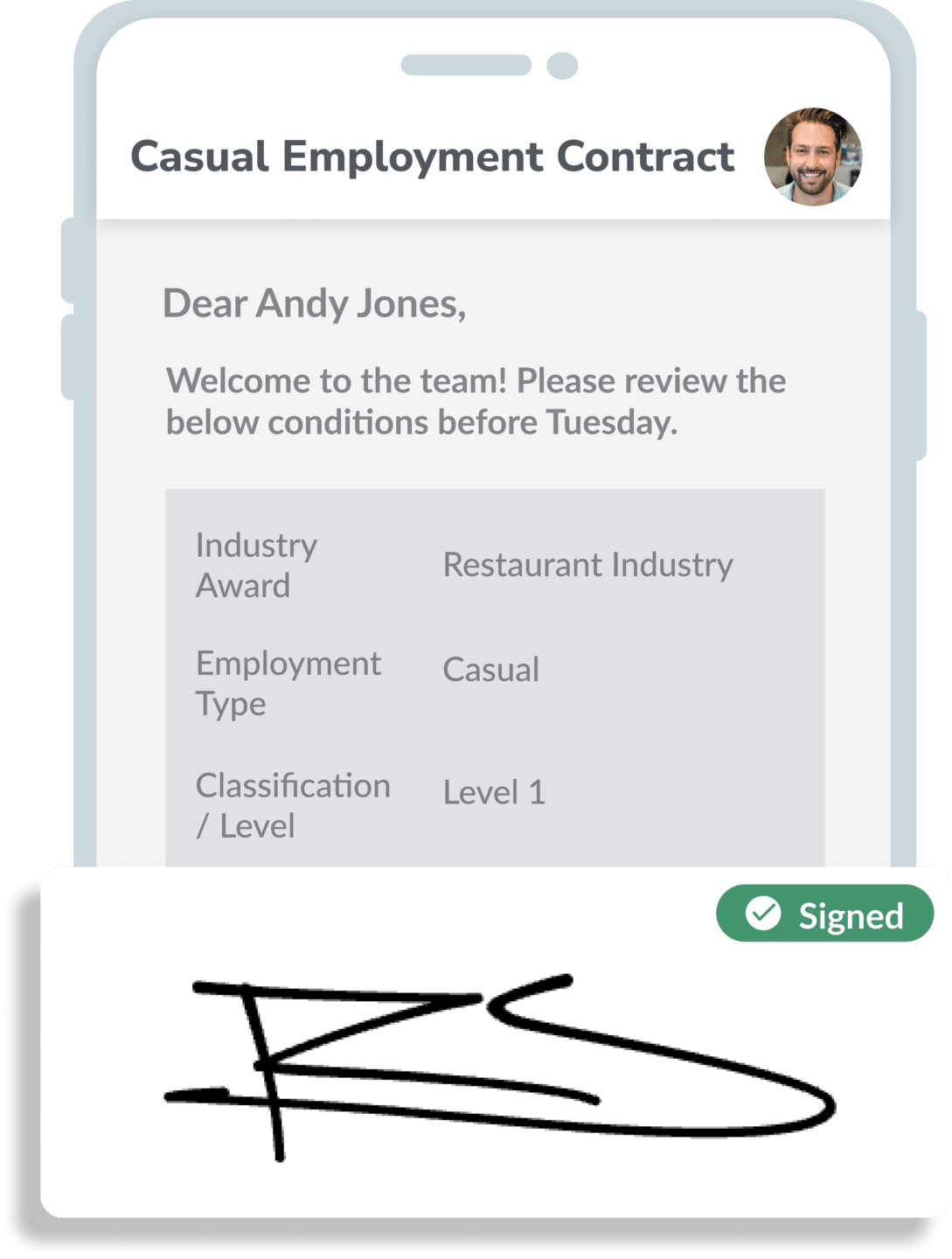

Contracts and Policies Prepared by Qualified Lawyers

Tanda has curated a suite of HR Legal Templates to simplify your contract and policy processes. Developed with Australian law firm Kingston Reid, templates include all legally required fields and reflect the latest employment law trends.

Agreements are fully managed and can be sent and signed with Tanda’s onboarding feature. Use Tanda’s HR Legal Templates to save on legal fees and stay compliant.

Gain complimentary access to the Employment Law Handbook, Australia’s most comprehensive, easy-to-understand guide to employment law.

Optimise Operations

Use operations to manage your most important daily processes, keep track of your assets, big & small, and maintain key compliance records for regulators and insurers.

Make sure the most important work is completed every shift and ensure day-to-day responsibilities are clear to your team – from area managers to front-line employees.

Streamline your processes by bringing paper forms online. Tanda HR allows staff to request fuel reimbursements, new uniforms, and more, all from the mobile app.

Trusted by businesses great and small

Happy partners of Tanda

Large businesses onboarded and loving life with Tanda.

Streamline your business with powerful integrations

Browse other features

Go the Tanda way, free for 14 days

Over 10,000 customers are achieving Workforce Success with Tanda today.

Try a 14-day FREE trial. No credit card required.

Frequently asked questions

Onboarding is the process of introducing new employees to the company and helping them become fully integrated with their new work environment. It typically involves paperwork such as completing an employment contract, providing employee identification badges and ensuring that all necessary safety information and training have been completed. Onboarding also includes orienting the new employee to company policies, procedures and culture.

Storing employee qualifications is important because it helps ensure the safety of employees and other stakeholders in the organization. It also enables the company to verify that employees are qualified to perform their duties and have completed all necessary training. This information can also be used for future recruitment purposes if an employee leaves the company or needs to be replaced due to illness or other unforeseen circumstances.

When storing employee information for the Australian Tax Office, you will likely need to collect and store the following details:

-Full name, date of birth, address, and contact information

-Tax File Number (TFN) or Certificate of Application for a TFN

-Employment start date and hours worked each week (if applicable)

-Employment earnings, including details on wages, pay and allowances received by the employee

-Superannuation fund information, including the name of the fund, number and type of contribution (employer or salary sacrifice contributions) made to the fund on behalf of the employee. You may also be required to provide additional information on the total amount of contributions made to all superannuation funds by your organization.