Employee Onboarding Software

Tanda’s Employee Onboarding Software makes adding new staff to your business painless.

Send new employees an invitation and they can fill out all their information digitally. Employee profiles are automatically synced with the ATO & super fund.

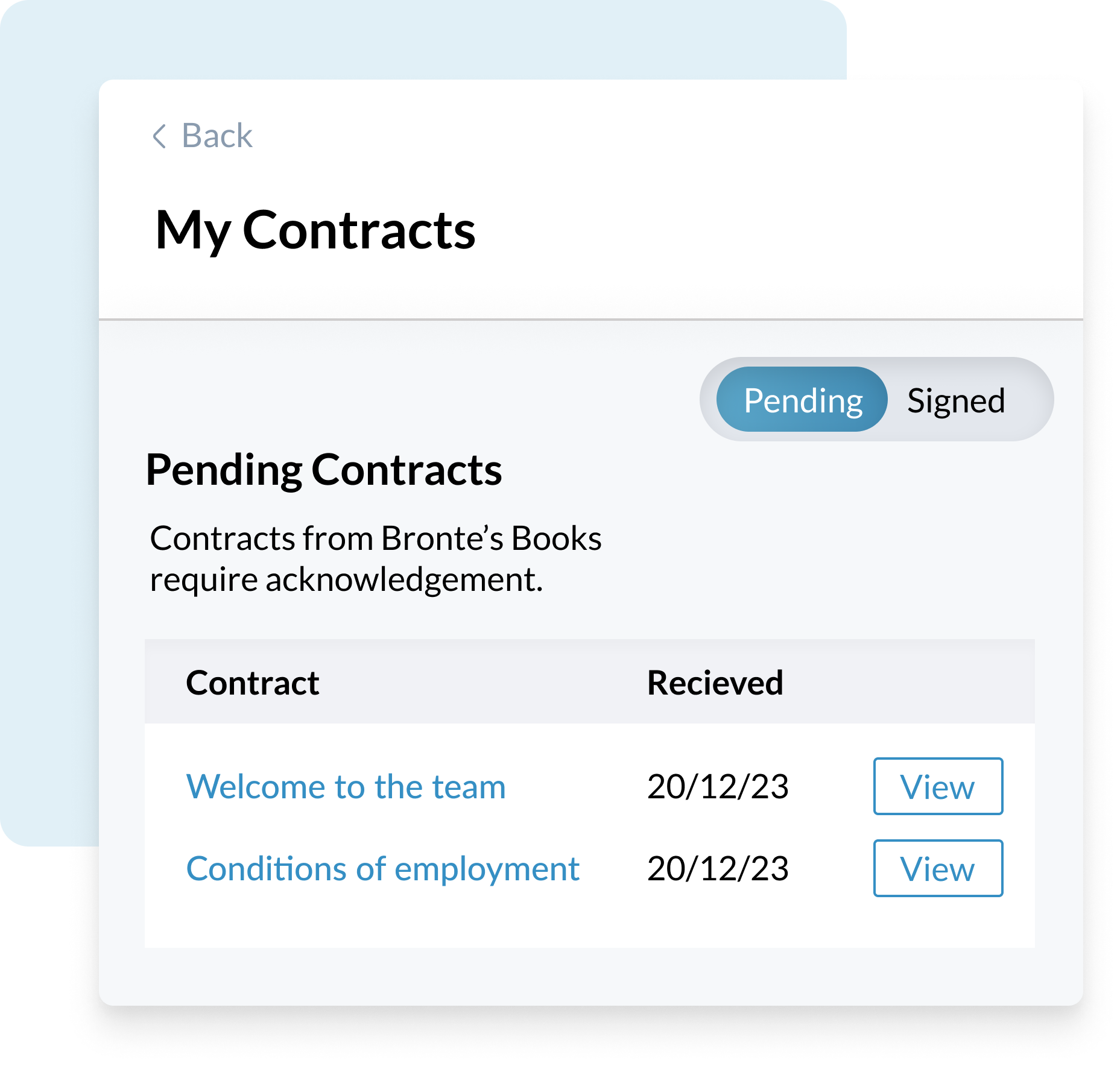

Send, sign, and accept employment contracts with Tanda’s Employee Onboarding Software. Get all of your processes in one place.

Digital Databases. Digital Accuracy.

Tanda’s Employee Onboarding Software automates the process of collecting employee details. It’s not just time you save – it means you never lose key details, like contracts, super, and ATO information. Tanda’s database keeps all your key information in the cloud, so you can forget about complicated manual filing systems.

New hires can hit the ground running with a digital onboarding process that’s easy, secure and hassle free. Whether on phone or computer, new staff members can receive and provide required information without the paper stack.

-

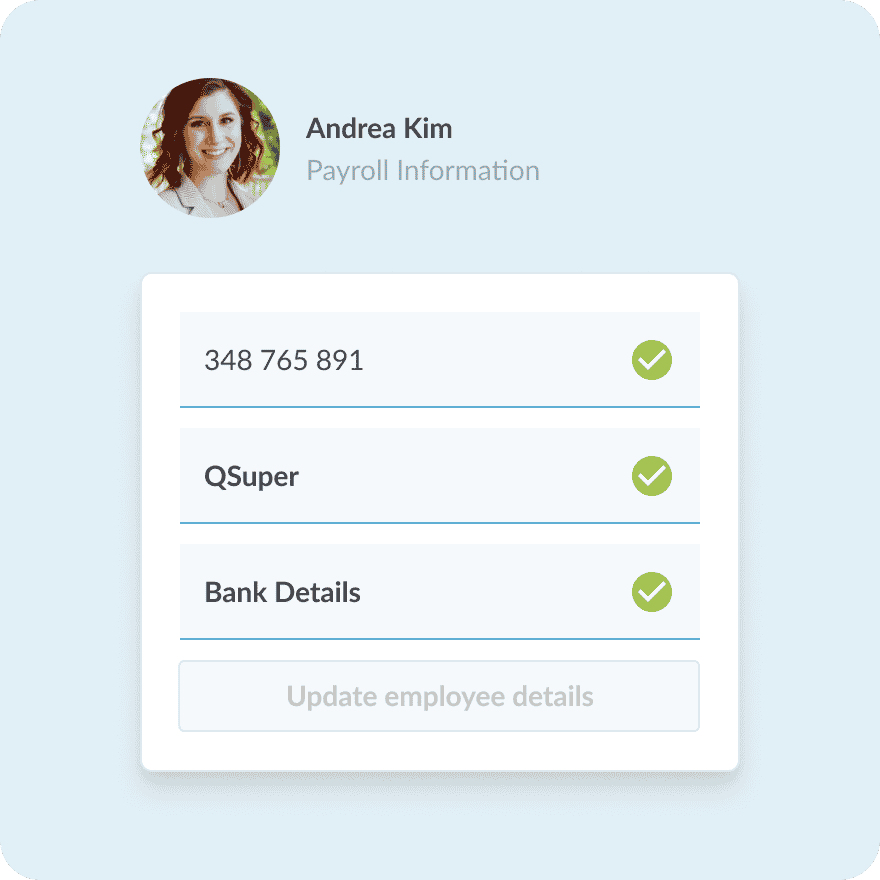

Personal details. Employees provide their personal information and bank details straight into Tanda and your payroll system.

-

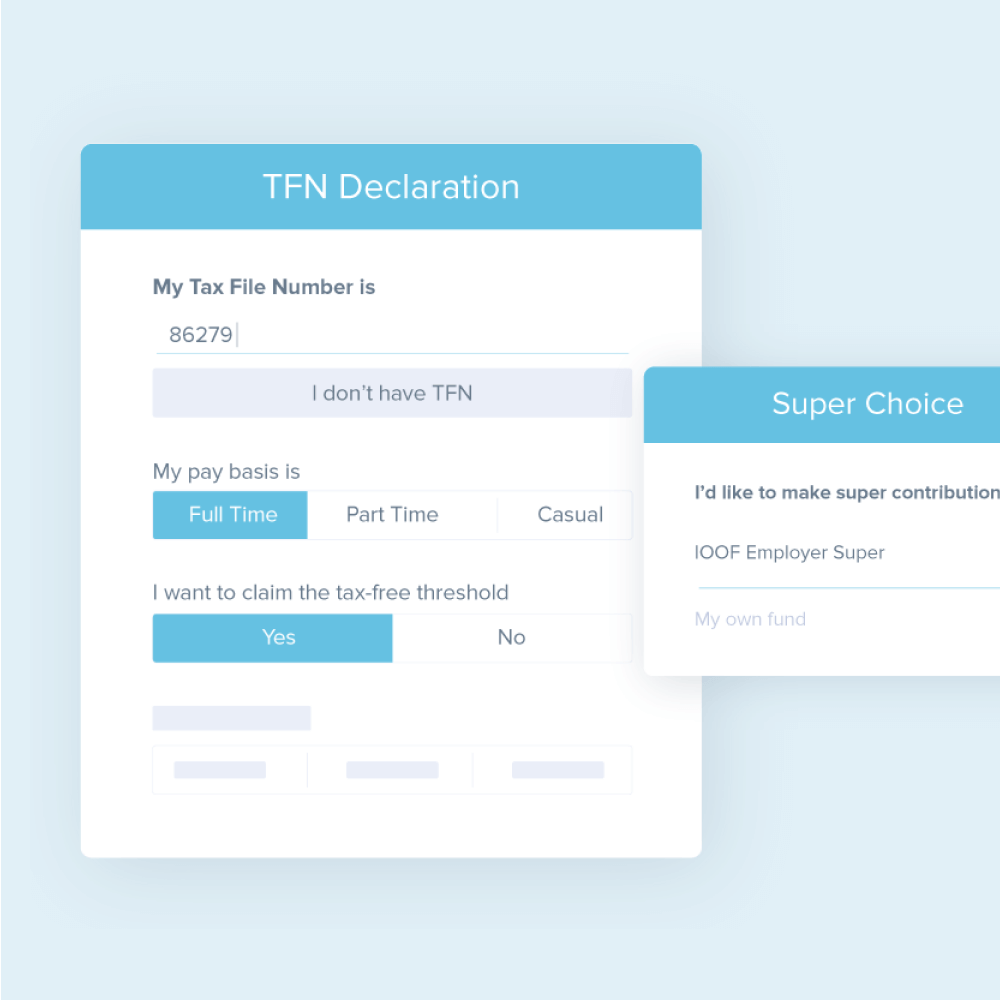

TFN Declarations. Save time with our legally compliant collection and lodgement of tax file numbers directly to the ATO.

-

Super Compliance. Employees bring their existing super or join your default fund and have it sync automatically with payroll.

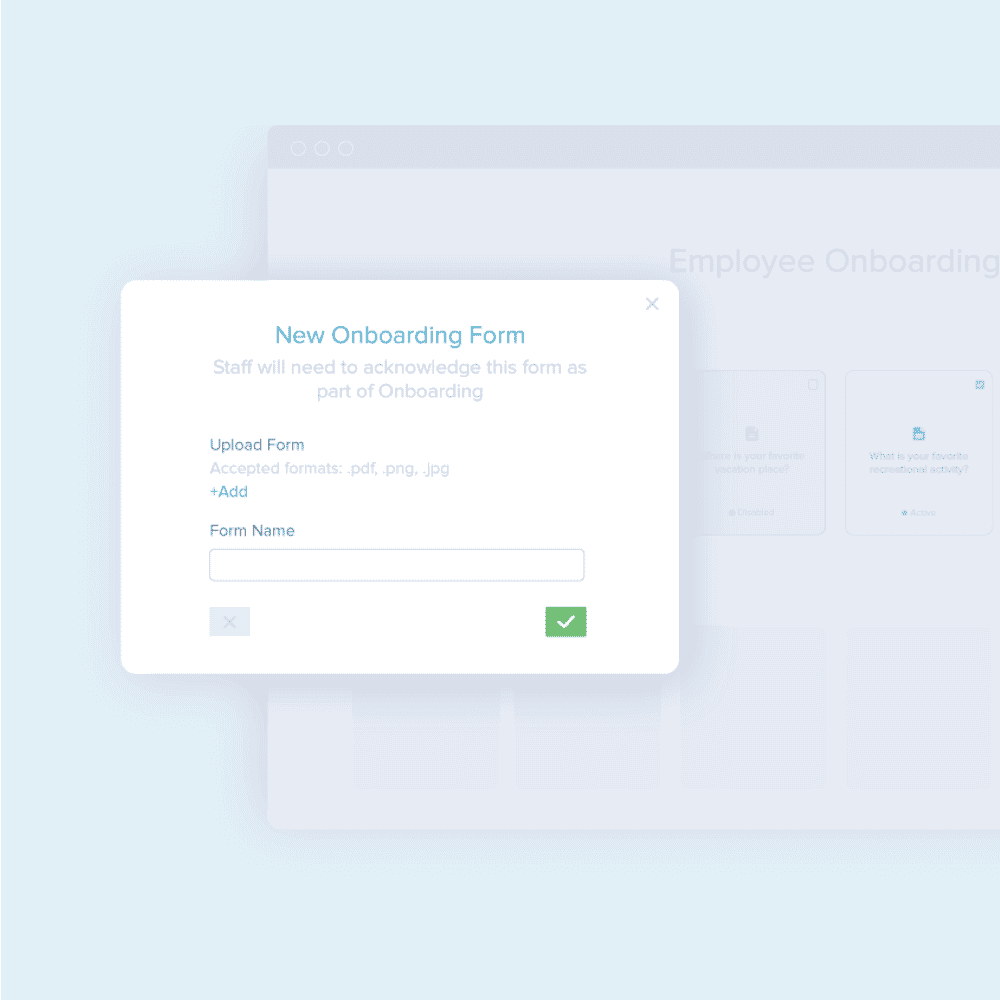

Tanda's Employee Onboarding Software allows you to distribute your company’s internal documents and other important policies to employees before they get started with custom employee onboarding. Change up what you send employees to suit your needs.

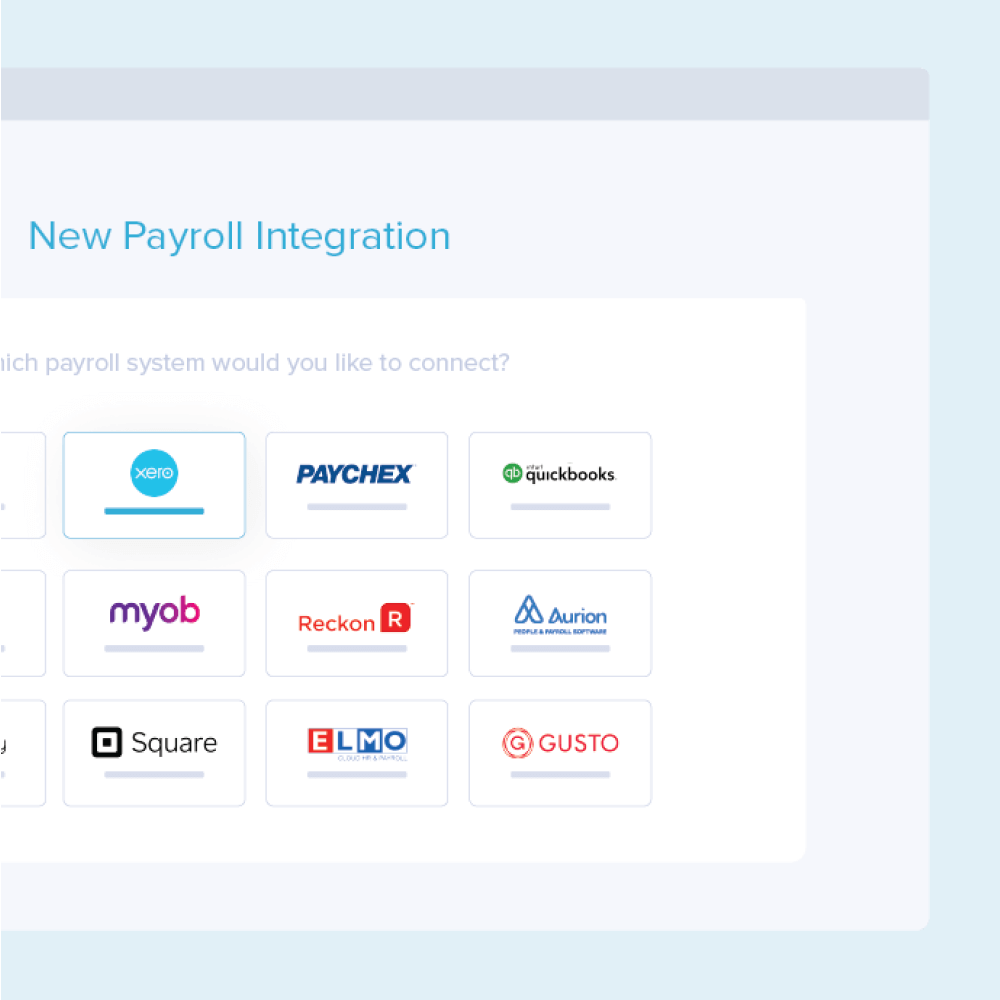

Onboarding with Tanda seamlessly integrates with your cloud accounting software. Onboard new staff and record details instantly in both systems, without lifting a finger.

Don't just collect required information for your employees with Tanda. Use our Employee Onboarding Software to send them their contract for acceptance too. Centralise all your processes in one place, cut down on admin, and never lose key documentation again.

Trusted by businesses great and small

Happy partners of Tanda

Large businesses onboarded and loving life with Tanda.

Streamline your business with powerful integrations

Browse other features

Go the Tanda way, free for 14 days

Over 10,000 customers are achieving Workforce Success with Tanda today.

Try a 14-day FREE trial. No credit card required.

Frequently asked questions

Employee onboarding software is a type of technology designed to automate and streamline the process of onboarding new employees to an organisation. It provides a digital platform for new hires to complete paperwork, receive training, and get acquainted with their new workplace and colleagues.

Typically, employee onboarding software includes features such as electronic forms and signatures, compliance and policy training modules, self-service portals for employee information, and task management tools to help managers and HR staff keep track of the onboarding process.

The software can also include tools to help new hires familiarize themselves with the company culture, such as company history and values, team introductions, and organizational charts. By using onboarding software, organizations can reduce the time and cost associated with manual onboarding processes, improve compliance, and provide a better experience for new hires.

As an employer or manager, onboarding employees is an important process that can have a significant impact on your organisation’s overall success. Here are a few reasons why onboarding is necessary:

-

Improves retention: A well-structured onboarding process can help new employees feel welcome, valued, and engaged in their new role. This, in turn, can improve employee retention and reduce turnover.

-

Increases productivity: When employees feel comfortable and confident in their new role, they are more likely to be productive and efficient. Effective onboarding can help new hires understand their job responsibilities, company culture, and how they can best contribute to the team.

-

Ensures compliance: Onboarding also provides an opportunity to ensure that new employees understand company policies and procedures, including those related to compliance with Australian laws and regulations. This can help mitigate legal and financial risks.

-

Enhances team dynamics: Onboarding can help new employees establish relationships with their colleagues, supervisors, and other key stakeholders in the organisation. This can improve team dynamics and overall collaboration.

Overall, onboarding is a crucial step in the hiring process that can help set the stage for a successful employment relationship. By investing time and resources into effective onboarding, you can help your new hires feel supported, empowered, and ready to contribute to your organisation’s success.

Using Employee Onboarding Software to collect onboarding information for the Australian Tax Office (ATO) is important for several reasons:

Ensuring compliance with tax laws: Collecting onboarding information helps the ATO ensure that individuals and businesses are meeting their obligations under Australian tax laws. This information is used to verify identities, determine tax residency status, and assess tax liabilities.

Facilitating efficient processing of tax returns: When individuals and businesses provide accurate onboarding information, it helps the ATO process tax returns more efficiently. This reduces processing times and minimises the risk of errors in tax assessments.

Improving communication: Collecting onboarding information enables the ATO to communicate more effectively with taxpayers. For example, the ATO can use this information to send updates and reminders about tax obligations, as well as provide relevant information about changes to tax laws.

Reducing fraud and identity theft: Accurate onboarding information is critical in preventing fraud and identity theft. By verifying identities and ensuring that the correct individuals are claiming tax benefits, the ATO can minimise the risk of fraudulent activity.

Overall, using Employee Onboarding Software to collect information is an essential part of ensuring compliance with tax laws, improving tax administration processes, and protecting taxpayers from fraud and identity theft.

Businesses need to collect the following information from their employees for the Australian Tax Office:

Tax file number (TFN): This is a unique number issued by the ATO to every taxpayer in Australia, and it is used to identify an employee’s tax records.

Personal details: This includes the employee’s full name, address, date of birth, and contact information.

Employment details: This includes the employee’s start and end date, salary or wage information, and any other benefits or allowances they receive.

Superannuation information: This includes the employee’s superannuation fund details and contribution amounts.

PAYG withholding details: This includes the employee’s tax status and any other relevant information needed to calculate and withhold their income tax.

It’s important to ensure that all the information collected is accurate and up-to-date to avoid any penalties or fines from the ATO. For more information, read here.