Introduction

G’day From Tanda

Over the past 10 years 200,000 Australian managers have used Tanda to manage and pay their workforce. In this time we’ve been asked just about every question there is about paying staff correctly, and just about everything about hospitality compliance too.

One thing we’ve learned is the answers to the most basic employment and pay questions are often deep within pages of legislation. To help our own teams provide helpful answers to customers we’ve spent years documenting the best straightforward answers.

Now, we want to share these answers publicly. We created this guide to be the quickest way for managers or executives to find answers to the most common questions about pay.

This guide is a starting point. You’ll find quick, straightforward answers. We’ve also provided links to the relevant sections of legislation and further reading where relevant. This means you can find a plain english explanation here, but also navigate to the full section of the law when you need.

Keep this guide saved or bookmarked for whenever you need to find a quick answer to a question about pay and conditions.

Andrew Stirling

Tanda Head of Product Compliance

Part 1: Pay Compliance

How to know if you’re on an Award or an Agreement

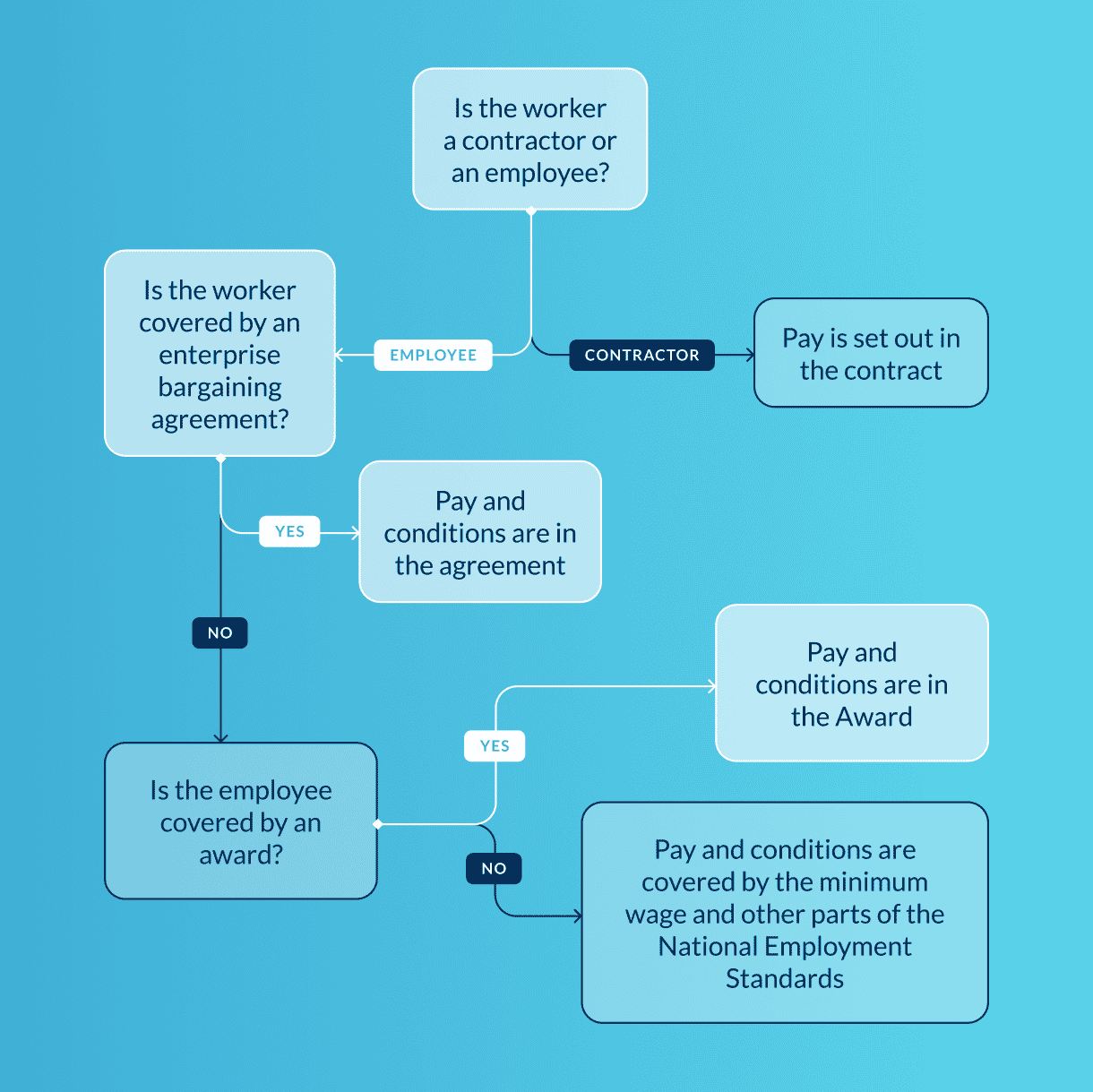

Australia has a few different frameworks for paying your employees. The two most common ones are Award and Enterprise Bargaining Agreement (EBA). It’s crucial you know whether your employees are paid with an Award or an EBA.

There are a few golden rules to remember if you’re confused about whether your covered by an award or an EBA. An EBA is directly negotiated with a trade union by a business, so there’s a good chance you’ll know about it if you’re on one. Having said that, it can be easy to miss existing agreements that roll over. Existing agreements are on Fair Work’s website.

Awards are different. The Fair Work Commission sets the pay and conditions for these instruments. Each year, Fair Work will sit down and determine the rates for each Award. Millions of workers have their pay governed by awards in Australia’s biggest industries. The idea is to try and strike a balance to give employees a fair go but not make wages so high that businesses can’t afford to hire workers. If it’s clear that your workers are not covered by an EBA, they are almost certainly covered by an award.

How do you know which Award should apply?

So, if you’ve worked out you’re under an Award, not an EBA, the next thing to do is to work out which one. The issue here is that there are heaps of Awards. Think about a barista for a moment. A barista can work in a number of different indutries and could be covered by the Fast Food Award, the Hospitality Award, the Restaurant Award and the Registered Clubs Award.

The best way to work which Award actually applies is to make sure that you have the correct name for the position and know your industry. From here, it’s straightforward to match the position and industry with an award. You can also check by using Fair Work’s Find My Award system.

It’s worth noting this creates a confusing situation where a barista that works for a fast food company could be paid a different amount to one that works for a cafe. While it doesn’t seem to make sense, this is absolutely how the system works.

Is The Worker Full-Time, Part-Time or Casual?

Full-Time

Full-Time employees are employed five days a week, often with a salary. They’re entitled to perks like annual leave and sick leave.

Part-Time

Similar to Full-Time employees, part-time employees have entitlements like annual leave and personal leave – although, they accrue them more slowly, since they work less.

Casual

Casuals don’t have any guarantee of hours written into their contract. This is very flexible for many businesses, who might need extra staff in peak periods. They also don’t receive annual leave, personal leave and other perks. In return they are paid an extra 25% per hour.

The Hospitality Award

The vast majority of workers in the hospitality industry are paid based on the Hospitality Award. A smaller number of workers are paid based on an EBA. The Hospitality Award is one of the biggest awards in Australia, covering people who work in pubs, clubs and restaurants across the country. It includes 500,000 people in jobs like food and beverage attendant, cook, and door person. The Award is a pay guide for your employees, and failing to follow it closely could see you fined by the Fair Work Ombudsman.

The problem is there are hundreds of different jobs, classifications, and pay rates within each award. One simple error could result in a worker being misclassified, or not given entitlements. If these issues persist for long periods of time, your business could have to pick up an underpayments tab that would make a big afternoon on the beers look tame.

Many of Australia’s notorious underpayment scandals have only seen minor variations from the correct hourly pay. Multiplied by many employees over months and years, this has sometimes added up to be hundreds of millions of dollars. So, how can you stay compliant? Read on for four simple steps.

The 4 Steps To Avoid Underpaying Wages

There is no catch-all silver bullet to ensure your wages are compliant with Australian law. The best solution is to take a rigorous approach to compliance, and have robust systems in place. With this in mind, Tanda has also created four – steps you can take to minimise risk:

1. Use a Digital System

One of the easiest ways to underpay an employee is to incorrectly record their hours. Many businesses use digital time clocks to record hours and remove any chance of an error. A digital system will see an employee enter a unique number to sign in and sign out at work. The system allows for the employee’s exact working hours to be automatically recorded and kept on file. From here, most Workforce Management Systems can “plug-in” to payroll software, reducing the time to process payruns.

2. Look at the Rules Thoroughly

It’s crucial to take a rigorous approach to interpret and implementing awards and enterprise agreements. Lawyers write these documents and they’re difficult to read. Don’t assume anything and thoroughly read and understand the award or agreement. Failing to pay close attention to the specifics of the agreement can easily lead to two key issues:

Incorrectly classifying an employee

Failing to correctly classify an employee is a major issue. The classification in an award governs their pay rate. If you incorrectly classify an employee, you will almost always pay them the wrong hourly rate. This means you will either overpay or underpay the employee.

Tanda’s Head of Product Compliance Andrew Stirling says it can be difficult to interpret agreements. “Award classifications can often be poorly written and really unclear. Businesses often make assumptions about the type of work an employee does that aren’t correct, or misinterpret the classification.”

Failing to fully implement the terms of an agreement

Awards and Enterprise Bargaining Agreements will often contain other entitlements and conditions for employees. Typical entitlements and conditions include things like annual leave and penalty rates. However, they can also include little-known and obscure terms, particularly in specific Enterprise Bargaining Agreements. Have a clear understanding of each term and implement it in full. If it’s difficult for you to understand parts of the agreement, it’s likely that your payroll team will have similar issues. Communicating to them in simple and clear language is a good way to solve the problem.

3. Perform Regular Annual Wage Reconciliations

One of the biggest mistakes business owners make is to simply assume offering someone a salary means that award benefits and other entitlements no longer apply. If someone is covered by an award, they’re entitled to those benefits, except in very rare circumstances.

Legally, an employee can’t be paid less per hour than they would earn under an award or agreement. This means that you need to make sure employees earning a salary aren’t earning less than they would if they were simply paid by the hour. This process is called an “annual wage reconciliation”.

Tanda’s wage compare feature allows you to perform an annual wage reconciliation at the click of a button. This takes pay data and reconciles it against hours worked in real time.

Use The Right Data

If you aren’t using a clock-in, clock-out system, you need to make sure your timesheets are accurate. Employee-filed timesheets are a good solution here. These are timesheets that the employee needs to fill out each pay cycle which confirm their hours. They need to be signed off by the employee. These timesheets can then be plugged into an annual reconciliation.

Use The High Income Guarantee To Avoid Reconciliations Altogether

If the employee is covered by an award, it’s possible to get around annual reconciliations. To do this, an employee needs to be paid more than $158,500 (excluding super and bonuses). The High Income Guarantee basically says that all of your entitlements under the Award are covered by your pay, which is quite high. To use the High Income Guarantee, you’ll need to draft it into the contract, and should seek legal advice.

4. Have Strong Governance and Embed Reviews

A robust governance system is the best insurance you can buy against wage underpayment. Putting in place systems and processes which are rigorous and pay close attention to detail will make it far more likely that the business picks up errors before they develop into serious issues.

Reduce Risk

You should identify systemic risks to wage compliance and reduce them as much as possible. Adopting a risk management hierarchy similar to the one used for workplace health and safety hazards is a good idea. The risk management hierarchy argues that risks should be eliminated or substituted for a smaller risk.

Embed Reviews

Don’t take a lazy attitude towards reviewing existing awards and agreements. Fair Work regularly updates awards. The courts also provide new interpretations of the rules. The tendency with many businesses is to “set and forget”, and hope that your previous interpretation will work and you won’t need to change the way you operate. The reality is that operating conditions change all the time, and your business needs to make sure it’s interpretations are still up to date.

Train Employees

There is no substitute for having well-trained staff in your business. Being able to spot potential compliance issues is important. Having well-trained staff will allow you to best utilise modern technology with competent oversight. Tapping into opinions independent of the business is also a good idea.

5. Comply with new outler limits rules

On the 1st of September 2022, new rules for annualised salaries came into effect for the Hospitality Industry General Award (HIGA), as well as the Restaurant Industry Award (RIA) . The change imposes stricter rules on businesses that use annual salaries for full-time employees. The changes will not apply to employees within the Managerial Staff (Hotels) classification level.

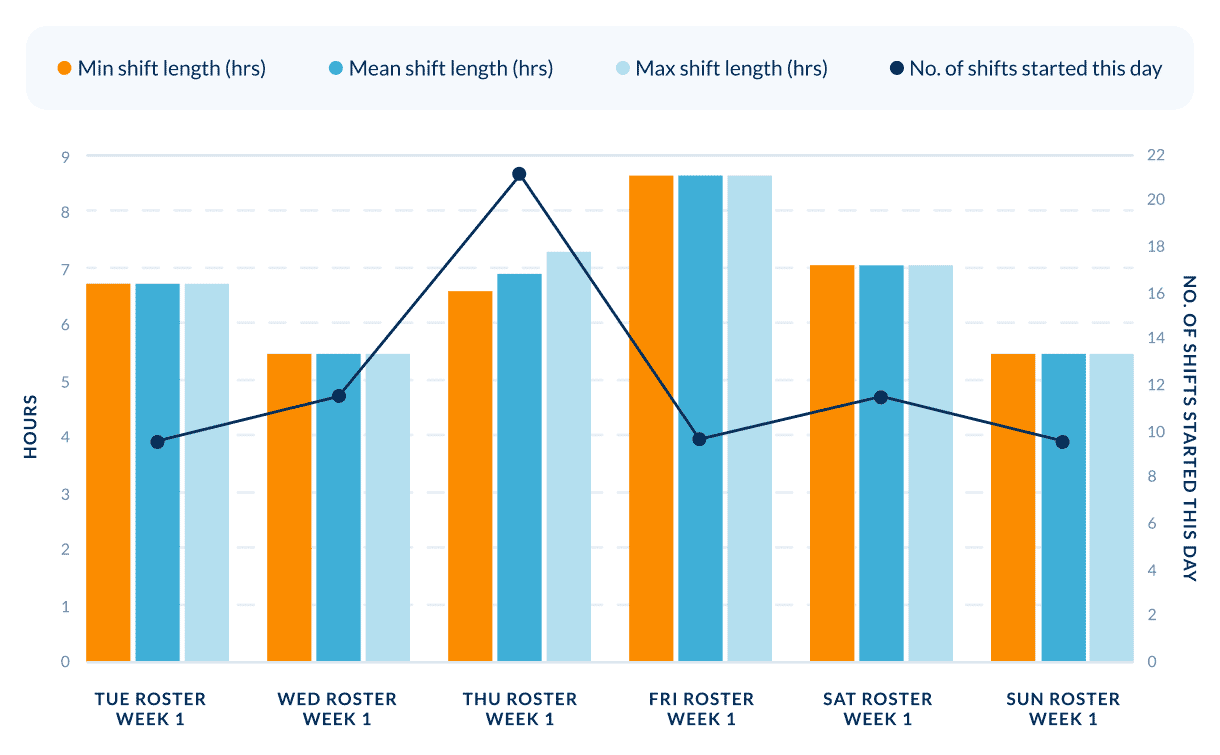

The changes to the hospitality award will require the employer to top up the annual salary if the employee works too many hours that are overtime or paid penalty rates under the award. The top-ups kick in if the employee works more than the following on average over their roster cycle:

- 18 ordinary hours which would attract a penalty rate, excluding any hours worked from 7.00 pm to midnight;

- or 12 overtime hours.

These averages apply over each roster period. If the employee works more than these hours, such hours will not be covered by the annualised wage and must separately be paid for in accordance with the applicable provisions of the award.

The best way to stay compliant is to reconcile these hourly limits alongside your roster. If you’re using Tanda, this can be done by using the wage compare feature, and exporting employee hours into a spreadsheet.

Businesses should also take the “Outer Limits” into consideration when designing their roster, as going over these hourly limits will incur additional costs.

While Tanda understands that every business will have slightly different needs, there are several generic options for businesses looking to reduce their cost risk. Remember, the hours are averaged across your roster period. A longer roster period would reduce the risk of having to pay staff extra.

Suppose there is an outlier event – say a big football game – needing your staff to work lots of overtime and penalty rate hours. If your roster is published every week, the average hours worked by annual salary staff that week would be very large and you’d likely have to pay extra costs.

But if the roster is published every 4 weeks, then those hours would be averaged across the entire period, meaning you’d be less likely to go over the outer limits. Of course, not every business has the ability to chop and change its roster so easily, and how you respond to these changes will depend on a host of business requirements.

How Fair Work Targets Business

We mentioned earlier that the Ombudsman massively ramped up audits and investigations in the last financial year. This year, restaurants, cafes, and fast food outlets will be major targets. In its annual report, the Ombudsman says this will be because of the industry’s “disproportionately high levels of non-compliance and vulnerable workforce”.

Yep, the Ombudsman is coming for the hospo industry.

It’s likely the Ombudsman will target these businesses through “surprise audits” of geographic food districts – a tactic already in use. In 2020-21, these included 50 businesses in Gold Coast’s Southport & Mermaid Beach food districts, and 56 in Adelaide’s Chinatown precinct.

This is a tough stance to take, but there are some simple steps you can take to avoid copping a fine. Fair Work only targets businesses it thinks are blatantly breaking the law. Often, these investigations are triggered by tip-offs from the public. Fair Work Officers are given Key Performance Indicators to give out a certain number of fines each year. They typically look for easy fines to give out, rather than complicated investigations.

Common issues include:

- Not having a system for checking payroll compliance

- Using manual processes for recording hours worked

- Poor or no record keeping

The Power Of Fair Work Inspectors

You can think of Fair Work Officers in a similar way to police officers placing speed cameras on a road where they’ll get the most fines. You are less likely to be fined if you avoid common problems. However, ticking a few boxes isn’t a guarantee you’ll avoid the wrath of Fair Work. You should still take a serious approach to compliance that rigorously tests your systems.

If you’re investigated by a Fair Work Officer, it’s important to cooperate. A Fair Work Inspector has a lot of power.

Powers To Enter The Premises

A Fair Work inspector can enter the premises if they believe the Fair Work Act applies to the business, and records relevant to compliance are on the premises. If you think that sounds broad, you’re right, they can come into the business very easily.

Before entering the premises they need to show their identity card, or as soon as they can after entering. They can’t use force to enter the premises, but they don’t need permission from the occupier. They can enter at any time during working hours.

Powers On The Premises

An inspector can do any of the following while they’re on the premises:

- Inspect any work, process or object

- Interview anyone (with their consent)

- Require a person who has access to a record to hand it over, and make copies of it

- Take samples of any goods or substances

Obstructing A Fair Work Inspector

If you’re thinking about obstructing a Fair Work Inspector, the short answer is: don’t. If you obstruct a Fair Work Inspector, there are massive fines to pay, up to $13,320 for an individual, and $66,600 for a corporation. Fair Work Inspectors take their job seriously and are not to be messed with.

Frequently Asked Questions

What’s the difference between a penalty rate and overtime?

The best way to think of this is this: overtime only applies when an employee works longer than their scheduled shift. Penalty rates are for things like working on a public holiday, working weekends or working at night. Penalty rates also apply to an entire shift.

So, when pay is calculated, if a worker works on a Sunday, they’ll get paid the Sunday penalty rate, and if they work for longer than their shift, they’ll get the overtime rate added onto their hourly pay.

What are allowances?

An allowance is an extra lump sum payment made to an employee who needs to do a specific task, work in dangerous or foul conditions, or cover an expense they make for doing their job. It’s best to check the individual award or agreement for which allowances apply. There are many allowances, but some common ones include:

- Uniforms

- Tools and equipment

- Travel and fares

- Car and phone

- First-aid

What are higher duties?

Higher duties are given to an employee who is made to do a duty normally done by someone with a higher rank than them. For example, if you employ someone at a pizza store as a level one cook, but make them perform manager duties, you may need to pay them higher duties. The duties are simply the pay rate for the higher level of classification. However, it’s not always that simple. Sometimes the worker will need to do the duties for a few days in a row to qualify for the higher rate.

One of the best ways to manage higher duties is to split your roster into teams. For example, a pub might have the restaurant team, the bar team, and the gaming team. If an employee in the bar team is needed to work in the gaming team, they’re moved into the gaming shift and automatically given a higher rate of pay. This can be achieved with simple rostering changes in Tanda.

When do you pay public holiday rates?

Public holidays vary across different states. Remember that some states award penalty rates for the Monday following a given holiday, while for others, the holiday simply falls on the Sunday.

We’ve put all public holiday rates in the appendix. Click your state or territory below to link to the rates

New South Wales

Victoria

Queensland

Western Australia

Tasmania

South Australia

Australian Capital Territory

Northern Territory

Part 2: Non-Pay Compliance

Casual Conversion

Under Australian law, Some casual employees have a right to become permanent. If a worker becomes permanent they’re entitled to extra benefits like annual leave and sick leave. This could seriously affect how your business operates. Casual employees don’t get benefits like annual leave and sick leave, but in return, get paid an extra 25% per hour.

Before we continue, small businesses with 15 or less employees don’t need to proactively offer conversion. You will only need to convert is the employee asks to become permanent.

So, how does this process work?

Employers need to assess if a casual is eligible once they’ve been employed for exactly 12 months. If the casual has had regular hours for the last 6 months, they’re probably eligible to become permanent. However, there could be reasonable grounds not to offer a permanent role.

You may be thinking no worries mate, but there is a lot of confusion over how the rules work.

- The law doesn’t say what regular hours are

- You need to know the reasonable grounds you can use to refuse casual conversion

- You need to keep the offer you send them to become permanent for 7 years

What are Regular Hours?

The biggest issue with offering casual conversion is confusion over what exactly regular hours are. The law doesn’t give clear advice here, but there are some good guidelines. You need to analyse the prior six months of timesheets and look for consistent themes. Remember, patterns don’t just relate to specific times each week. Even if different shifts are worked each week, you need to consider total hours per week, and total hours per day. If there’s a consistent pattern, the casual could be eligible to become a permanent employee.

Tanda’s casual conversion dashboard is a great way to identify if the employee works consistent hours. It gives a visual overview, making it easier to identify patterns. Tanda also records employee’s hours when they clock-in, and you can also record the conversion offer in Tanda when it’s sent out, so you can relax when the Fair Work Ombudsman comes knocking.

Keep Everything On File

You need to keep track of everything for seven years. Yep, seriously. Record the employee’s hours of work, any offer to convert to permanent employment, and whether they accept the offer. One of the biggest things Fair Work inspectors will look for is poor or weak record-keeping. We recommend using a digital system that keeps track of all documents for seven years.

Can I Refuse Casual Conversion?

In some circumstances, you can refuse to offer casual conversion. You need what’s called “reasonable grounds” not to offer permanent employment. This will differ depending on the circumstances, and some of the rules could still be established in court. However, there are some existing reasons to refuse conversion:

- The position won’t exist in 12 months

- Total hours of work will significantly reduce

- Patterns of work will significantly change

For Tanda’s complete guide on consistent hours, click here.

Avoid Sham Contracting

Contractors sit in a different category. Remember, contractors aren’t employees – so they aren’t covered by the NES, Award Rates, and EBA’s. But, that doesn’t mean you can do whatever you want. Sometimes, the courts will find a contractor is actually an employee.

Contracting laws can get pretty complex, and pretty political too. Federal Labor is proposing to change laws that would give contractors in the gig-economy more rights, for example.

Sham contracting is the term Fair Work uses to describe situations where a worker is paid as a contractor when they are really an employee. Independent contractors have different rights and obligations to employees. Sham contracting carries a heavy penalty and you should make sure your contracts are legal.

So, what separates sham contracting from legal contracting? The biggest thing is control over the work. For someone to be classified as an employee, there needs to be an obligation they perform work, and be paid for that work.

But, there are many more factors that need to be taken into account, which we’ve put into the list below.

1. Control of The Work

A business can direct an employee exactly how to do a certain piece of work. This is standard procedure. By comparison, contractors will often be told to do the work, but with less instructions on exactly how it’s done. However, sometimes the contract will have some specific terms of how the business wants things to work. Whatever the case, contractors will have more freedom in terms of how they get things done.

Contractors can also delegate work and subcontract out to other people. An employee obviously can’t just get on the phone and pay someone else to do the work they’ve been told to do. However, a contractor can. A contractor might decide part of the job needs some specialist skill, and pay someone else to do it.

Contractors are independent of the business, and are their own business doing a deal with you. Employees are not.

2. How They’re Paid

This is a key difference. A contractor will quote a price, and be paid that amount to do the job. By comparison, an employee is paid either by the hour, per activity, or paid commission.

3. Who Takes On Risk

If it all goes belly up, an employee won’t be copping any of the cost of fixing a project. They’re paid to do the work by the hour. A contractor is different – they’ll face liability and indemnity for fixing faulty work.

4. Who Supplies Tools and Equipment

It pretty much goes without saying, but most businesses supply employees with tools and equipment needed to do their job. Employees are given an allowance by the business if they need to supply their own equipment. Contractors are different – they supply most of the equipment and tools, and don’t receive an allowance.

Managing Underperformance

In Australia, managing underperforming employees is difficult. You need to be very careful how you deal with the situation. If you breach the rules a worker can easily file an unfair dismissal claim, costing your business thousands of dollars.

When you manage underperformance, you could discipline an employee, dismiss the employee for misconduct, or make the employee redundant. Typically, businesses choose to discipline employees first, although if there’s a serious misconduct issue, they may choose to terminate them.

Underperformance

If an employee is underperforming at work, it’s a good idea to address it. Remember, underperformance is different from serious misconduct, which we’ll deal with a bit later.

According to Fair Work, underperformance can include

- Not doing work, or not carrying out work to the required standard

- Not following workplace policies, rules or procedures

- Unacceptable behaviour at work

- Disruptive or negative behaviour at work

Before you move to address underperformance, you should make your expectations clear. A written performance management policy is a good idea, and remove any doubt for workers. From here, you can move to address the issue.

1. Hold a Private Meeting

The first step is to have a chat with the employee about their performance. You should be professional and clear in this meeting about their underperformance. You should document the meeting, including clear and reasonable steps they can take to improve.

2. Discipline The Employee

Disciplining the employee is a serious step and you need to be prepared to justify the move. Do not discipline the employee if you don’t have a valid reason and follow a fair process. The warning should be given in writing, with a clear reason and expectations of what needs to be done differently. It should also be detailed.

You should also get legal advice.

3. Termination

You should only consider termination if it’s absolutely necessary. You could issue additional warnings or change their duties before terminating them. There is a myth that the employer must give three written warnings before termination. This is not correct, but the employee does need to be given the chance to fix any performance issues.

When you terminate the employee, you need to make sure they aren’t being unfairly dismissed, they’re given the right notice of termination, and the right final pay.

Serious Misconduct

Serious misconduct is very different to underperformance or a redundancy. Fair Work gives three definitions for serious misconduct:

- When an employee causes serious and imminent risk to the health and safety of another person.

- When they cause serious risk to the reputation or profits of their employer’s business.

- Deliberately behaves in a way that’s inconsistent with continuing their employment.

The first definition is simple enough. But the other two are a bit of a word salad. Basically, they can mean things like theft, fraud, sexual harassment or refusing to do part of their job.

Serious misconduct is grounds for termination. You don’t have to provide notice of termination. This means the employee can be told their employment is ending immediately. However, you do have to pay all outstanding entitlements – like wages, annual leave other accrued benefits. There is no redundancy payout.

Redundancies

A redundancy happens when a business says someone’s job no longer exists and no one needs to do it. The ex-employee is given a payout for losing their job, as well as their outstanding entitlements. However, you need to take care. Someone can apply for unfair dismissal if their sacking was “harsh, unjust, or unreasonable”, and it was not a genuine redundancy. However, they can’t apply if they work for a business with 15 employees or less.

Unfair Dismissal

If an employee believes they’ve been unfairly dismissed, they have 21 days to apply to the Industry Relations Commission.

From here, they need to have been working for at least 6 months before they can apply for unfair dismissal (12 months if they work for a small business).

The courts will agree with an employees dismissal claim if all of the following is true:

- The Employee was dismissed

- Their dismissal was harsh, unjust or unreasonable

- Their dismissal was not a case of genuine redundancy

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $12.16 | $14.60 | $21.89 | $26.76 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $9.73 | $12.16 | $19.46 | $24.33 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $13.51 | $16.22 | $24.32 | $29.73 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $10.81 | $13.51 | $21.62 | $27.03 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $16.21 | $19.46 | $29.18 | $35.67 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $12.97 | $16.21 | $25.94 | $32.43 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $18.91 | $22.70 | $34.04 | $41.61 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $15.13 | $18.91 | $30.26 | $37.83 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $21.61 | $25.94 | $38.90 | $47.55 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $17.29 | $21.61 | $34.58 | $43.23 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $24.31 | $29.18 | $43.76 | $53.49 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $19.45 | $24.31 | $38.90 | $48.63 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $21.62 | $27.03 | $43.24 | $54.05 |

Level | Hourly Pay | Saturday | Sunday | Public Holiday |

Level 1 | $27.03 | $32.43 | $48.65 | $59.46 |