Following the continued slew of high-profile underpayment cases and sweeping changes to industrial relations laws, including the criminalisation of ‘wage theft’ in Victoria and Queensland, it’s clear that underpayments are a widespread problem amongst Australian businesses.

With so many high-profile organisations being caught off guard, many industry leaders are left wondering how they can protect their own organisations from underpayments.

What’s causing underpayment Issues to rise to the surface?

Wage miscalculations have always been an issue, with the Australian Payroll Association finding 33% of businesses admit to making on every single pay run.

However, over the last two to three years, and especially in the last 12 months, Australia has seen a large escalation in the amount of media coverage into underpayment scandals. This creates a snowball effect whereby increased media coverage prompts regulators such as the Fair Work Commission to increase enforcement. Increased public scrutiny also prompts state and federal governments to spotlight the issue and take action in the form of changes to industrial relations law, such as the criminalisation of wage theft.

Award requirements to complete BOOT and reconciliation

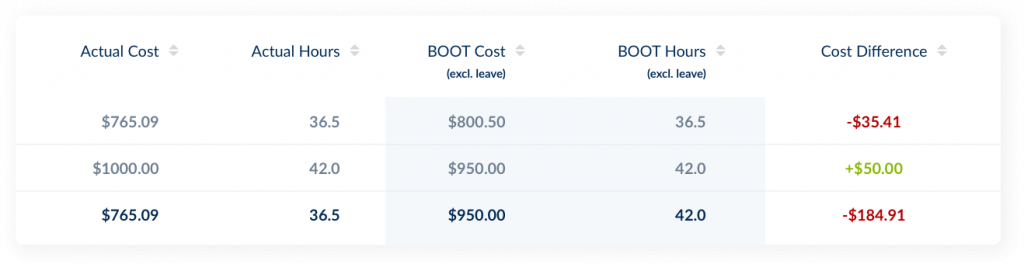

On top of increased public attention, amendments to over 20 modern awards require employers to perform a better off overall test and reconciliation every 12 months, for employees paid under annual wage arrangements. While these changes have been successfully added to many modern awards, there is no mandated or prescribed best practice for employers looking to complete the requirements.

How do you detect an underpayment in the workplace?

How to check for underpayments manually

Traditionally, employers would be required to manually calculate a paycheque using fair work’s comprehensive award rules, inclusive of all entitlements and allowances an employee would incur. They would then extrapolate this across a year and make a comparison with their salary or enterprise agreement.

This process is not just time-consuming but prone to human error due to the growing complexity of rules found in modern awards as well as ambiguity found in the interpretation of those rules.

How to check for underpayments automatically

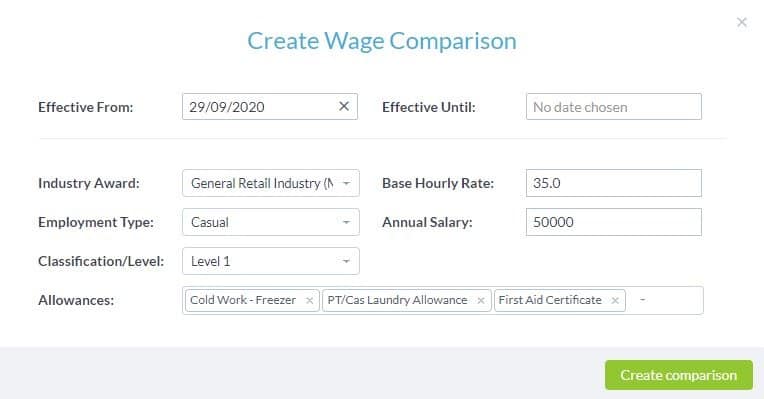

Tanda is proud to announce the full release of our latest compliance tool Wage Compare. This tool leverages the power of our existing award interpretation engine, allowing employers to directly compare an employee’s salary or enterprise agreement against the award and all its rules.

Within Tanda, simply set up an employee with both an award classification and an annual salary. Timesheets are then run through Tanda’s market-leading payroll calculator to determine how much the employee would have been paid under the award vs their agreement.

Employers can then run a report on staff to identify which employees are being paid safely on or above the award, and which employees are potentially being underpaid on their agreements.

Processing a reconciliation in the event of an underpayment

After running Wage Compare, you may find that some employee’s salary or enterprise agreement does not leave them better off overall.

Tanda’s Wage Compare feature has now completed beta testing and is available to all users on an active Tanda subscription.